CAFOD 'disappointed' as G20 fails to cancel developing world debt

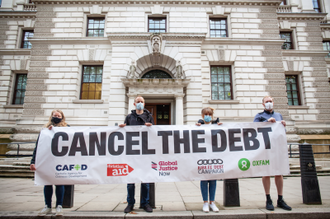

Campaigners outside Treasury call for debt cancellation. Image: CAFOD/Thom Flint

Source: CAFOD

Against a backdrop of a world reeling under the coronavirus pandemic - in spite of appeals from international humanitarian aid agencies and campaigners - in their virtual meeting today, the G20 finance ministers failed to cancel any developing world debt.

Dario Kenner, CAFOD's Sustainable Economic Development analyst commented: "Private creditors are profiteering off the backs of the world's poorest people. Any debt relief that developing countries might receive from donor governments is only snatched away again by private creditors who continue to demand repayments.

"Private creditors like BlackRock, JP Morgan and HSBC have failed to do the right thing so it's now time for G20 governments to compel them to cancel the debts of developing countries. This will free up money that is urgently needed to tackle the health and economic impacts of the coronavirus pandemic."

LINKS

CAFOD Briefing paper: https://cafod.org.uk/About-us/Policy-and-research/Private-Sector/Under-the-radar