MPs' report calls for laws to rein in banks refusing to cancel debts of low income countries

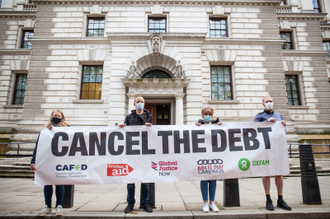

Campaigners outside Treasury call for debt cancellation in 2020. Image: CAFOD/Thom Flint

MPs have called for landmark laws to prevent UK-based banks from suing low-income nations and compel private lenders to take part in debt relief. This could release much needed public funds for priorities such as schools, hospitals and adapting to climate change.

The intervention from cross-party MPs underlines the severity of the situation, as they call for legislation due to private lenders showing time and time again they cannot behave responsibly when it comes to cancelling debt of low-income nations.

The majority of private creditors hold debt under English and New York law, meaning many are bound by UK law and could be compelled to act on debt relief if UK legislation demands.

Responding to the report, Dario Kenner, Policy lead on debt at CAFOD, said: "It is shameful that banks and investors are refusing to cancel debts, further deepening the global debt crisis which is forcing countries to choose between paying for schools and hospitals or face being sued.

"Just look at what Blackrock and other private lenders are doing. Zambia's been in default since 2020, its economy is in limbo, all because Blackrock and other creditors can't agree on debt cancellation.

"This report shows we're beyond the point of waiting for these cowboy lenders to take part in debt relief when they feel like it. With most bond contracts eligible for the G20 debt relief scheme governed by UK law, the government must listen to this report and act by putting an end to irresponsible banks continuing to profiteer during a global debt crisis."

The report by the International Development Select Committee also found that low-income countries are spending more on debt servicing than at any point for at least 30 years. Other findings include:

- The amount of debt repayments that African countries are due to make in 2024 and 2025 is six times higher than the total sum those countries expended on servicing debt in 2021.

- Debt is significantly limiting low-income countries ability to fund basic public services and climate change mitigation.

- Cuts to the UK's Official Development Assistance from 0.7% to 0.5% has significantly reduced the UK's ability to support the development of low-income countries.

Speaking about the ongoing issue and why the UK is uniquely placed to resolve it, the report states:

"private lenders and debt holders have little incentive voluntarily to engage in debt relief schemes or unilaterally to provide debt relief. Robust measures are necessary to facilitate the participation of all creditors. The UK is uniquely placed to tackle these issues, because of its international influence, its legal system and its track record of promoting positive change."

Debts owed to private banks, asset managers and hedge funds are shrouded in secrecy and complexity. There is no comprehensive or independent mechanism for renegotiating or cancelling this debt giving these private creditors enormous power over developing countries.

CAFOD research identified major private creditors, including BlackRock, HSBC, Goldman Sachs, Legal & General, JP Morgan and UBS are bondholders of Eurobonds in countries such as Ghana, Kenya, Nigeria, Zambia and Senegal.

In recent years, the heads of the World Bank and IMF have publicly suggested that legislation related to private creditors could be needed to speed up debt restructurings.

CAFOD's partners across the global south were part of the jubilee 'Drop the Debt' campaigns in the 1990s and 2000s. Today they are again at the forefront of campaigning for debt cancellation in countries such as Zambia and Sri Lanka.

Twenty years ago, the majority of global south debt was held by northern governments and the World Bank and IMF. The role of private creditors in debt relief is increasingly important as they hold nearly half of foreign debts of low- and lower-middle income governments.

For more information and to read the full report click HERE

CAFOD submitted written evidence to the inquiry which can be obtained here: https://committees.parliament.uk/writtenevidence/109386/pdf/.